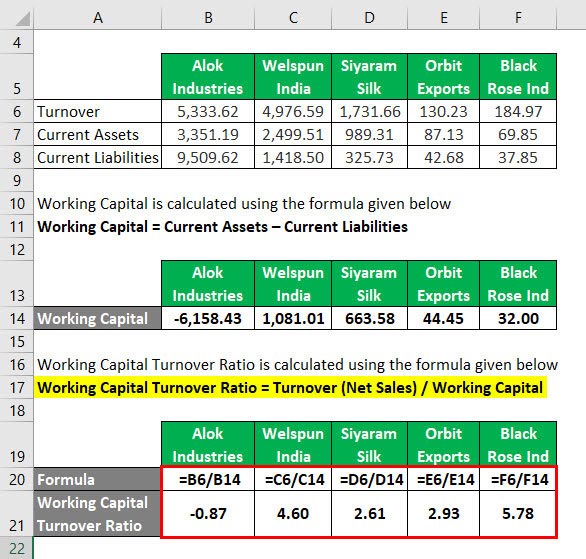

Hence, there is obviously an assumption that working capital and sales have been accurately stated. The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements. The higher the sales, the more the profits and therefore the more appropriate use of working capital has been made. This is why this ratio is also called Working Capital Turnover Ratio as it measures the number of times working capital has been turned over. When companies use the same working capital to generate more sales, it means that they are using the same funds over and over again.

Which one do you think will be more profitable? Which one do you think is more efficient? While one company uses this working capital to generate sales of USD 500, the other uses the same amount as working capital to generate USD 1000 in sales. Consider two companies, both having the same working capital of USD 100. Stating the working capital as an absolute figure makes little sense. Working Capital to Sales Ratio = Working Capital / Sales Meaning

0 kommentar(er)

0 kommentar(er)